Measure and keep: 7 key customer retention metrics to watch

Table of contents

The goal for most B2B marketers is simple: generate leads that sales can potentially convert into customers. While 61% of marketers find lead generation to be their biggest challenge, it seems that the size of this challenge is causing them to “not see the forest for the trees.” Sure, getting leads to convert is great for business – but do you know what’s even better for business? Having converted leads stick around to become long-time customers.

Fortunately for B2B marketers, the remedy to this problem doesn’t require racking your brain to find the next lead generation channel that somehow eluded you – and it’s much closer than you think. As they say in horror movies, the call is coming from inside the house. It’s your current customers that hold the solution to increasing your company’s bottom line.

Customer retention is the real key to sustainable success in business. Keeping your customers – and keeping them buying from you – brings tangible benefits to your bottom line. According to studies from Gartner Group, 80% of your company’s future revenue comes from just 20% of your existing customers. In the big picture, marketing can and should have a lot to say about nurturing. When it comes to customer retention, marketing needs to be a major contributor to these efforts – which aren’t really that different from lead generation, after all.

With that in mind, it becomes clear that savvy B2B marketers will include a strong customer retention strategy as part of their marketing plan. The question then becomes, how do you know if your customer retention plan is working effectively?

The answers can be found in customer retention metrics. In this post, we’ll explore the importance of customer retention, show you the seven metrics to watch to see if you’re getting results, and how to use this data to keep your best customers locked in, long-term.

What is customer retention?

In marketing, customer retention is defined as the process of persuading existing consumers to continue buying more products or services from your company. Customer retention is also a metric, equaling the percentage of customers who stay with a company for a certain length of time. In other words, customer retention is the measurement of the amount of customers your business was able to keep.

Customer retention has an evil twin: churn. Churn is the measurement of the percentage of customers you have lost over a certain period. Like real-life twins, churn and customer retention are related. Reducing churn increases customer retention, and increased churn results in lowered customer retention.

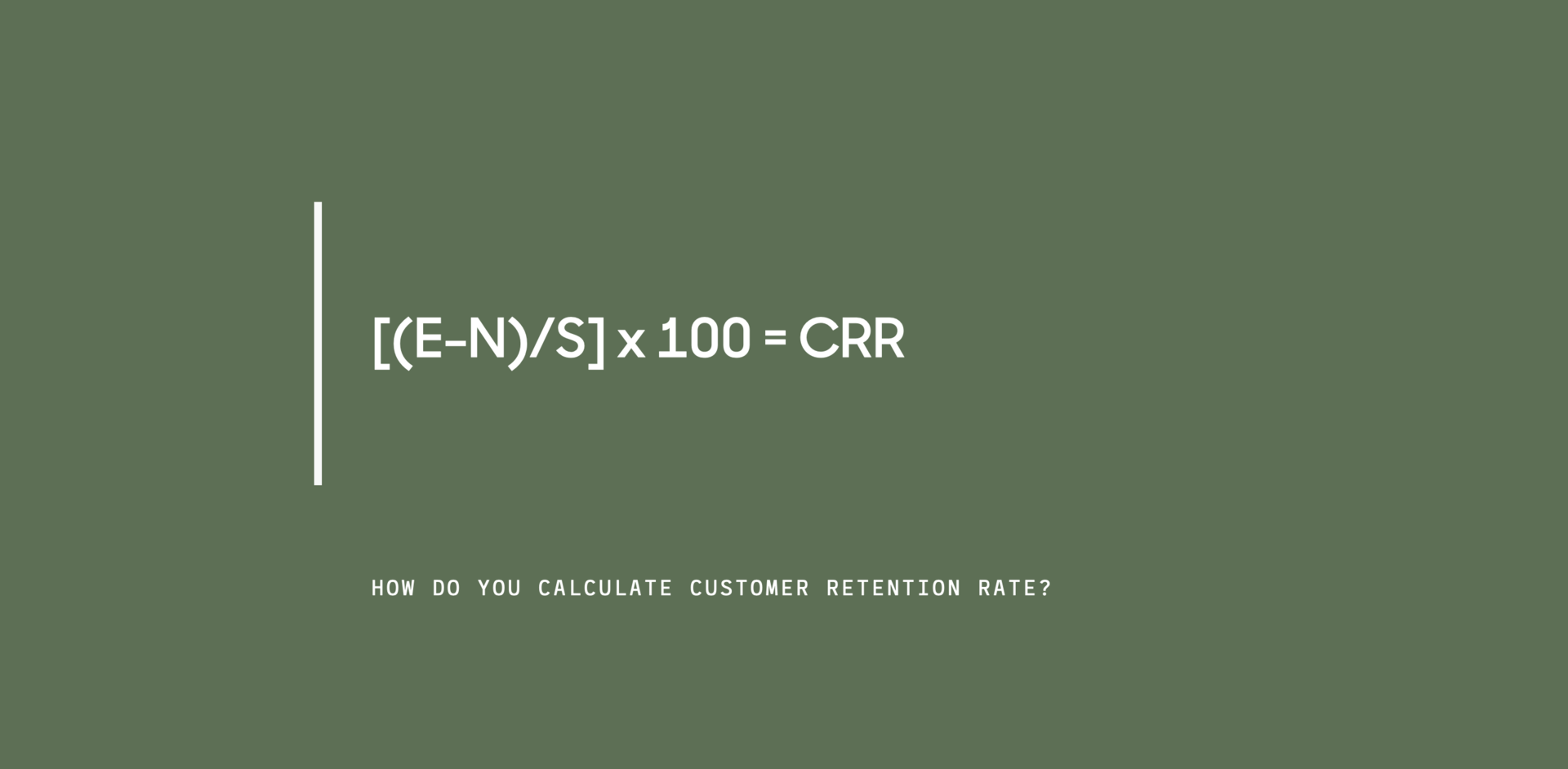

Customer retention rate is measured by taking the total number of customers you have at the end of the period being measured (E), subtracting the number of new customers you gained during that period (N), then dividing the resulting figure by the number of customers you had at the beginning of the period being measured (S). Then, multiply the result by 100 to get a percentage, which is your customer retention rate.

Churn rate can be easily measured because it’s the inverse of your customer retention rate. If your customer retention rate is 70%, then your churn rate is 30%. The formula is:

Churn Rate = (Churned customers/Original customers) x 100

Knowing the rate at which you retain and churn customers is crucial to developing successful strategies to keep more customers. Reducing churn increases your bottom line, and a high churn rate serves as a kind of fire alarm to let you know when things aren’t working right, so it’s essential to measure these metrics regularly.

Why is customer retention so important for B2B?

Customer retention is the evil twin of churn, and the country cousin of customer loyalty. Customer retention is a broader phrase that describes a company’s capacity to convert new consumers into repeat customers. A customer that continues to buy from a particular brand, company, or business is said to be loyal. They are less susceptible to competitor marketing and are not actively shopping for the same product or service elsewhere.

Customer retention metrics can be used to measure customer loyalty – and retained customers often become long-term, loyal ones that will lead to increased profits over time.

(Source: https://www.act.com/en-uk/what-is-customer-retention)

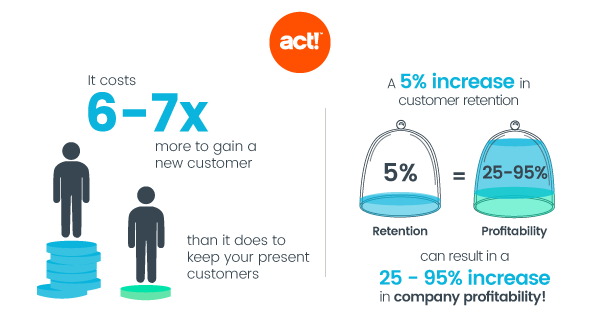

An important consideration for any B2B marketer is their Customer Acquisition Cost. It turns out that the cost of keeping a customer is up to five times less expensive than the cost of going out and getting a new one. Keeping existing customers happy and satisfied ends up being much cheaper than acquiring leads and bringing them through the funnel.

According to Inc., your existing customers will also spend more than new customers – up to 67% more, on average. Since you already have a relationship with these customers and have their trust, it makes it easier to upsell or cross-sell to them. Another benefit of retaining customers is that they trust you enough to refer you to their friends, bringing in new business organically and in a less costly way than through marketing campaigns.

Recommended for further reading

7 key customer retention metrics to watch

Certain key metrics will let you know how your customer retention efforts are doing, and serve to help you really understand your customers. Knowing your numbers also can show you where to improve – and even a small improvement can have major results. Studies have shown that increasing customer retention by only 5% can boost your profits from 25% to 95%. Let’s learn what metrics you need to monitor to allow your business to increase its profitability.

1. Existing customer revenue growth rate

Knowing this metric is essential for your business. If it’s rising, it shows that your teams and campaigns are having success and that your customers are getting significant value from your business. If it’s stagnant, it indicates that you may need to allocate more money and greater efforts towards customer retention and account based marketing. If the number is falling, your business may be in trouble – so you need to find what’s wrong and fix it, fast.

To calculate your Existing Customer Revenue Growth Rate, you need to know your existing customers’ Monthly Recurring Revenue (MRR). Do not include new sales. The formula is:

Existing Customer Revenue Growth Rate = (MRR at the End of Month – MRR at the Start of Month) / MRR at the Start of Month

2. Repeat purchase ratio

The percentage of customers who repeatedly buy more products and services from your business is your Repeat Purchase Ratio (RPR). A high RPR is a good indication of high customer loyalty. A useful application of this metric is to input data for different customer demographics. The results can help you more finely hone customer personas and improve marketing to those target audiences.

RPR can be calculated for any period, making it helpful in looking at small windows of time or the overall big picture. To determine your Repeat Purchase Ratio, use this formula:

Repeat Purchase Ratio = # of Returning Customers / # of Total Customers

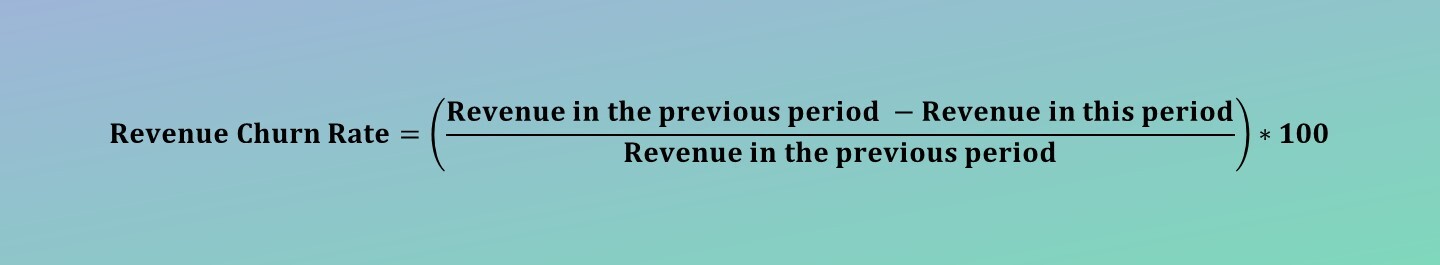

3. Revenue churn rate

The percentage of revenue you’ve lost from your existing clients in a certain period is your Revenue Churn Rate (RCR). A key marker for customer satisfaction, RCR can be impacted by such events as canceled orders, downgraded subscriptions, or customers leaving for new suppliers.

Knowing your RCR can assist you in figuring out which of your products or services are underperforming and help you make strategic changes to your retention strategy. Significant revenue churn with a single customer can also be a red flag showing that the customer might be on the way out the door.

RCR is calculated in a similar way to Churn Rate. It’s best calculated on a quarterly basis. The formula is:

4. Net Promoter Score

Sadly, your Net Promoter Score (NPS) has nothing to do with basketball. The NPS is a numerical indicator of general brand satisfaction and loyalty. Once you’ve computed your overall Net Promoter Score, you’ll know if your consumers are happy with your products or services and willing to recommend them to others.

NPS, which was created by Bain & Co., has gone beyond being simply a metric and is now used as a company-wide system to foster customer-centricity. A powerful use for NPS is estimating prospective growth through customer retention and referrals by comparing your score to your revenue growth rate and customer churn rate.

Unlike most metrics, Net Promoter Score is calculated with a common question found on customer surveys:

“How likely are you to recommend our company to a friend or colleague?”

Customers are asked to rate the likelihood of referring your company to their family and friends on an 11-point scale (0-11). Customers are divided into three categories by the ratings they provide:

- Promoters: 9-10

- Passive: 7-8

- Detractors: 0-6

Once the customer scores are in, use this formula to determine your NPS:

Net Promoter Score = %Promoters – %Detractors

5. Customer Lifetime Value

Customer Lifetime Value (CLV) is the ultimate measure of how much your customers are worth. It’s the value of how much the customer purchases during the entirety of their relationship with your business.

For this number to show that a particular customer is valuable, it needs to be at least 3x the cost of acquiring that customer. It’s important to track this metric consistently to understand which of your customers are high or low value. If you discover you are attracting too many low-value customers, then you can modify your marketing to attract the right targets.

CLV can be increased over time, and your business will experience more growth the higher it gets. To increase CLV, employ upsells and cross-selling, new products, and implement new pricing tiers.

The CLV metric measures the amount a customer generates in revenue for your business, minus their overall revenue churn. To calculate it, use this formula:

Customer Lifetime Value = Average Revenue Per User/MRR Churn (for that customer)

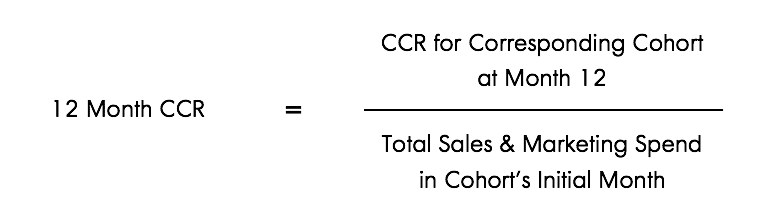

6. (and 7.) Cumulative Cohort Revenue

We’re going to give you a bonus here with two metrics in one entry. Cumulative Cohort Revenue (CCR) is the total amount of revenue generated from a group of customers gained over a set period. It’s generally calculated for a period of 12 or 24 months. Analyzing CCR is another way to appraise the value of your customers.

However, you need another metric to get the most from CCR – the previously mentioned Customer Acquisition Cost (CAC). Here’s how it works.

First, determine your CAC by using this formula:

Customer Acquisition Cost = Total expenses to acquire customers/Total # of customers acquired

Next, calculate your CCR. First, determine who your cohort is (the group of customers being measured). Then, run through the jungle using this formula to determine your CCR:

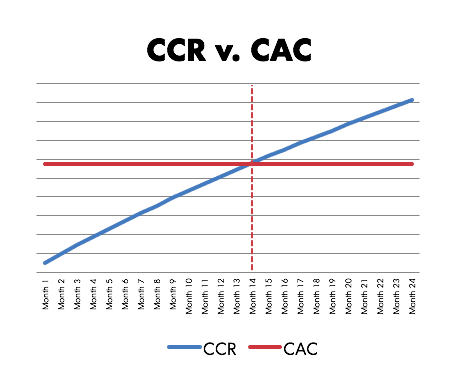

Now compare the two metrics. Use a graph, and you may get something that looks like this:

So, what does this tell us? By comparing your CAC and CCR, you learn:

- Exactly where you break even on your Customer Acquisition Cost

- How fast you recoup the money you’re spending on CAC

- If you are improving over time in retaining high-value customers

CCR offers a great way to batch groups of customers over set periods and then use the results of your analysis to find ways to improve your results on either the retention or acquisition ends of the spectrum.

Measure and keep

In today’s highly competitive B2B landscape, more and more marketers are making customer retention a primary focus of their efforts. Retaining customers brings many valuable benefits to businesses, including savings in time and customer acquisition costs, and increased long-term profits. Customer retention metrics provide critical data that businesses can use to understand more about their customers’ preferences and adjust their marketing approaches, resulting in a higher customer retention rate.

By measuring the metrics discussed here and applying what you learn to a comprehensive customer retention plan, you’ll be on your way to growing your bottom line and keeping many long-term, satisfied customers.